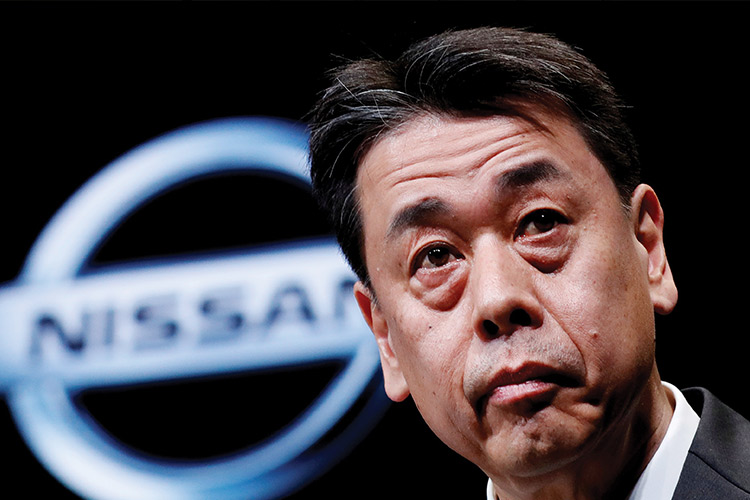

Nissan Motor slams output cut report as ‘totally incorrect’

Models with Nissan Sylphy at the Shanghai Auto Show in China. Agence France-Presse

The comment came after the Nikkei, revered in Japan for its business news and known for its market-moving scoops and previews, said Nissan would cut its global production by about 15 per cent for the current fiscal year ending March 2020.

The move would mark a shift away from the aggressive expansion campaign promoted by ousted former Chairman Carlos Ghosn, the Nikkei said.

“The details reported in this story are completely incorrect, and Nissan has voiced its strong objection to the Nikkei,” the Japanese automaker said in a statement posted on its website.

“Nissan’s production plan for the current fiscal year will be disclosed on May 14, when the company announces its financial results for the previous fiscal year,” said the maker of the Rogue sport-utility vehicle and Altima sedan.

The Nikkei reported that Nissan aimed to produce about 4.6 million units in fiscal 2019, citing plans being communicated to the automaker’s suppliers. The move was likely to impact earnings and could cast a pall over Nissan’s alliance with French automaker Renault SA, the Nikkei said without elaborating.

That would be the steepest production cut in more than a decade by the Japanese automaker, as it battles weak sales in overseas markets including the United States where it plans to scale back sales operations, according to the Nikkei.

Earlier this year, Nissan, which has been battling falling sales, lowered its operating profit forecast for the current fiscal year to 450 billion yen ($4 billion), 22 per cent lower than a year earlier. It would be Nissan’s lowest profit since 2013.

Japanese companies typically respond to media reports by saying they were not the source of the information and, depending on the content of the report, that they may be considering various options and that nothing had been decided.

It is rare for a Japanese firm say it has issued a strong rebuke to a media outlet.

Shares in Nissan, mired in a financial misconduct scandal involving Ghosn and the company itself, closed down 2.2 per cent on Friday, versus a 0.5 per cent rise in the broader market.

Japan’s Nikkei rose on Friday as investors snapped up cyclical stocks, while Nintendo jumped after Tencent won approval to sell its Switch console in China.

The Nikkei share average ended 0.5 per cent higher at 22,200.56 points. For the week, the index rose 1.5 per cent to post its third straight week of gains.

Shares of Nintendo Co soared after China’s Tencent won a key approval to begin selling Nintendo’s Switch console in China, the world’s largest games market. The video game maker’s shares ended up 14 per cent.

Risk appetite was buoyed by overnight gains in US markets, which were driven by robust economic data, while industrial stocks rallied after China’s commerce ministry said there had been new progress in US-China trade talks.

“The mood has recovered as the market has been able to confirm that a slowdown in the Chinese economy has hit bottom, and that the US and China are making progress in their trade talks. Those were the market’s main concerns,” said Takashi Ito, an equity market strategist at Nomura Securities.

China’s economy grew at a steady 6.4 per cent pace in the first quarter, data showed on Wednesday, defying expectations for a further slowdown, as industrial production jumped sharply and consumer demand showed signs of improvement. But analysts cautioned it is too early to call a sustainable recovery.

“While such macro data is improving, US companies started releasing their earnings, and Japanese companies’ earnings will be in focus later in the month as well,” Ito said.

Machinery, sea transport and electronics stocks outperformed, offsetting weakness in defensive stocks such as railroad operators and utility firms.

Tokyo Electron rose 2.3 per cent, Fanuc added 1.4 per cent, Okuma soared 2.3 per cent, Kawasaki Kisen advanced 1.2 per cent. East Japan Railway shed 1.1 per cent and Tokyo Gas declined 1.7 per cent.

The broader Topix gained 0.1 per cent to 1,616.93.

Meanwhile, South Korean Hyundai Motor has appointed Jose Munoz as global chief operating officer and Americas chief, tapping a man formerly considered an ally and potential successor of Nissan Motor’s ousted Chairman Carlos Ghosn.

Munoz is the latest foreign executive to be brought in to a South Korean automaker dominated by lifelong loyalists, as heir-apparent Euisun Chung strengthens control of the conglomerate chaired by his aging father.

Reuters