Global stock markets diverge as investors track earnings

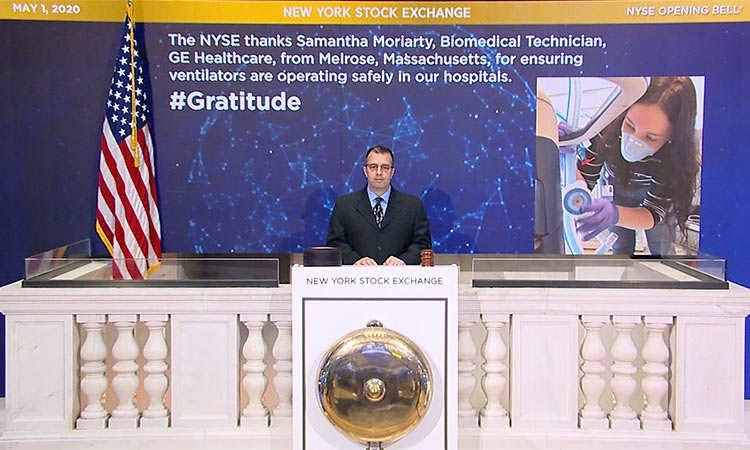

Photo used for illustrative purpose.

The Dow fell at the open but the tech-heavy Nasdaq advanced and the S&P 500 jumped above 5,000 points, which it had briefly touched the day before.

“The fourth quarter earnings season is proving to be a positive factor for investors,” said David Morrison, senior market analyst at financial services provider Trade Nation.

“Absenting a few shockers, the majority of corporations have beaten expectations for both earnings and revenues, even though those expectations were fairly low to begin with,” he added.

US equities have marched higher as strong earnings along with data showing resilience in the world’s number one economy helped overcome Federal Reserve warnings that interest rates will not come down as early as hoped.

“Investors have taken encouragement from hearing large dollops of positive guidance from company executives for the year ahead,” Morrison said.

Figures released Thursday showing below-expectation US jobless claims reinforced the view that the labour market remains in good health despite interest rates sitting at two-decade highs, but gave the central bank room to hold borrowing costs where they are for longer.

The Fed hiked rates to a two-decade high last year in efforts to tame inflation.

Consumer price index report on Friday showed a downward revision in December to 0.2 per cent on a monthly basis from 0.3 per cent previously. Traders now turn their attention to the January CPI next week.

Among individual stocks, Expedia shares dropped almost 20 per cent as it reported lower earnings compared with the year-ago period.

PepsiCo fell almost four per cent after the snacks and soft drinks company reported a drop in fourth-quarter sales.

Major tech stocks were mostly higher on the back of largely positive earnings reports this week.

European stock markets were in the red in afternoon deals.

French luxury giant Hermes bucked the trend, its shares rising almost five per cent after posting record annual sales and net profit.

The gains propelled the group above L’Oreal as France’s second biggest company in terms of market value as the cosmetics company’s stock price fell almost seven per cent after it posted lower-than-expected results for the fourth quarter.

Gold slipped on Friday and was heading for a weekly fall, pressured by elevated Treasury yields, while investors awaited next week’s US inflation data for more clues on the timing of the Federal Reserve’s interest rate cuts.

Spot gold was down 0.4% at $2,025.49 per ounce at 10:16am and fell 0.4% over the week.

US gold futures also lost 0.4% at $2,040.30 per ounce.

Canada’s job growth: Canada’s economy added net 37,300 jobs in January, beating expectations, while wage growth slowed slightly in the same month, data showed on Friday, figures that are likely to keep the Bank of Canada in a holding pattern despite pressure to start cutting interest rates.

The unemployment rate in Canada edged down to 5.7% from 5.8% in December, posting its first decline in 13 months, Statistics Canada said, mainly because fewer people were seeking jobs. The participation rate fell to 65.3% from 65.5% in December.

Analysts polled by Reuters had forecast net job gains of 15,000 and for the unemployment rate to rise to 5.9%.

The average hourly wage growth for permanent employees slowed to 5.3% in the month from 5.7% in December.

The Bank of canada (BoC) has kept its key overnight rate at a 22-year high of 5% since July, as it strives to bring inflation back to its 2% target.

Money markets have been pushing back expectations for a first quarter-point reduction to borrowing costs, now seen as most likely in July, as the BoC warned of persistent underlying inflation, which was 3.4% in December.

“Today’s data suggest that the Bank won’t be in a rush to cut interest rates, and we maintain our expectation for a first move in June,” said Andrew Grantham, an economist at CIBC Capital Markets.

The central bank expects economic growth to remain soft in the first quarter of 2024 and expand by a modest 0.8% for the full year. Wage growth, which can fuel inflation, has largely been above 5% all of last year.

The Canadian dollar was trading 0.3% higher at 1.3425 per US dollar, or 74.49 US cents.

The BoC closely tracks employment data to gauge the health of the economy and the year-over-year wage growth to keep a tab on changes in purchasing power.

Higher job gains or faster wage growth can affect the central bank’s effort to sufficiently cool inflation and start lowering interest rates.

January’s job gains were led by part-time work, and entirely in the services sector. Largest job additions were in the wholesale and retail trade, followed closely by finance-related jobs.

The goods sector lost jobs, led by construction and manufacturing sector.