Markets up on Powell comments and Chinese stimulus measures

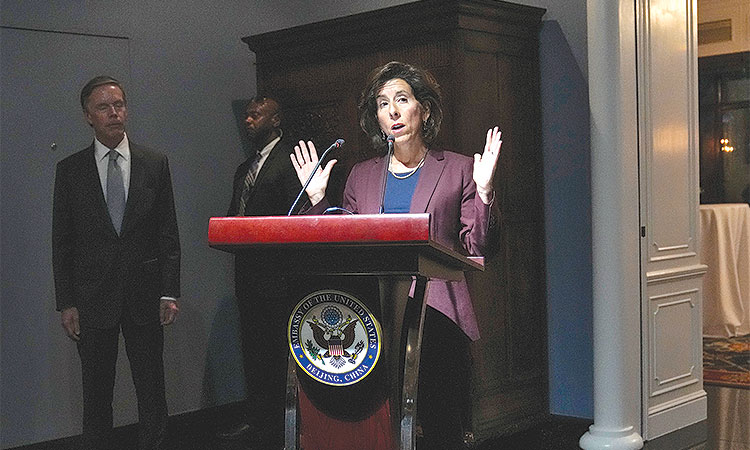

US Commerce Secretary Gina Raimondo delivers her speech in Beijing, China, on Monday. Associated Press

“Fed Chairman Jerome Powell’s speech last Friday had something for both hawks and doves, but market reaction continues to look positive early Monday,” economists from Charles Schwab wrote in a note.

“Powell’s comments seemed to ease investor concern that further rate hikes may be coming,” they added.

While inflation is coming down, a recent run of strong economic data -- particularly on jobs -- has been seen by markets as putting pressure on the Fed to keep hiking interest rates.

The Fed’s data-dependent approach makes inflation and jobs data out this week even more important before the Fed’s rate-setting meeting next month.

“If the data continues to show an ease in labour market tightness and price pressures, then the Fed is likely done with its tightening cycle,” said National Australia Bank’s Rodrigo Catril.

“If the data doesn’t play ball, then further tightening should be expected. Thus, upcoming key market data releases (inflation and labour market) are likely to set the tone for markets over coming months.” Wall Street’s three main indices were all higher in late morning trading.

In Europe, the Paris CAC 40 index briefly rose above London’s blue-chip FTSE 100 for the first time since 2000, although trading was closed Monday in Britain due to a public holiday.

While the development is a further indication of the recent difficulties of the London Stock Exchange, analysts said it has no real significance given their different composition.

Asian markets mostly closed higher. Shanghai was boosted by China’s decision to slash the tax paid on stock trades for the first time since 2008 as authorities battle to support the world’s second-largest economy.

Officials also said they would slow the pace of new listings, which usually suck up market liquidity, following a series of pledges from the authorities that have failed to lift optimism.

Analysts at China International Capital Corp said the latest measures beat expectations.

“The increasing force of the policy tools will lift market confidence, amplifying the positive signal for the market,” they said.

But Stephen Innes at SPI Asset Management was more sceptical about their potential impact.

“While the emergence of more accommodative measures is encouraging, the reality remains that these interventions seem somewhat fragmented, particularly within the broader context of the substantial property market downturn,” he said.

The moves came as shares in troubled Chinese property giant Evergrande resumed trading in Hong Kong after a 17-month suspension for not publishing financial results.

They plunged more than 80 percent after it released its earnings Sunday showing losses of $4.53 billion in the first half of the year and just $556 million in cash assets.

Once China’s largest real estate firm, Evergrande defaulted in 2021 and is saddled with more than $300 billion in liabilities, becoming a symbol of a nationwide property crisis that many fear could spill over globally.

Investors were also keeping tabs on US Commerce Secretary Gina Raimondo’s talks with Chinese counterparts in the latest bid to ease trade tensions between the world’s two largest economies. They agreed to set up a working group on bilateral trade and investment issues.

Euro zone government bond yields edged higher on Monday as investors awaited data from the bloc and the U.S. later this week after central bankers in Jackson Hole did not provide additional cues about the direction of monetary policy.

A rally in stocks triggered a bit of a selloff in safe-haven bonds. Bond prices move inversely with yields.

“I wouldn’t read too much into today’s yield rise,” said Hauke Siemssen, rate strategist at Commerzbank.

“Markets are actually waiting for inflation data, after comments from Lagarde and Powell (on Friday) that were on the hawkish side but not more hawkish than expected,” he added, referring to European Central Bank (ECB) President Christine Lagarde and U.S. Federal Reserve Chair Jerome Powell.

Germany’s 10-year government bond yield, the benchmark for the euro area, was up 2.5 basis points (bps) at 2.58%, after reaching 2.59%. It was between 2.55% and 2.57% on Friday in the four hours before Powell’s speech at the Jackson Hole symposium.

“Jackson ultimately didn’t deliver any fireworks. Looking forward, we expect volatility to stay low,” Citi analysts said in a morning note to clients.

Austrian central bank chief Robert Holzmann, seen as an ECB hawk, mentioned ending Pandemic Emergency Purchase Programme (PEPP) reinvestments, adding that he sees a case for raising interest rates further in September.

Money markets price slightly less than a 50% chance of a 25 bps ECB rate hike in September, after falling to around 40% last week as HCOB’s flash Composite Purchasing Managers’ Index (PMI) for the bloc was weaker than expected.

Agencies