Merchandise trade deficit in India at $20.13 billion in June

Labourers stand in a queue to load sacks of grocery items onto a supply truck at a wholesale market in Kolkata, India. Reuters

India’s merchandise trade deficit in June was in line with expectations at $20.13 billion, according to a Reuters calculation based on export and import data released by the government on Friday.

Merchandise exports stood at $32.97 billion, while imports were $53.10 billion in June. In the previous month, merchandise exports were $34.98 billion, while imports stood at $57.10 billion.

Economists expected a June trade deficit of $20.10 billion, according to a Reuters poll.

India’s exports remained weak for several reasons including a slowdown in the world’s major economies, Trade Secretary Sunil Barthwal told reporters.

Services exports in June were $27.12 billion, while imports were $15.88 billion. In May, services exports were $25.30 billion and imports were $13.53 billion.

For the April-June period, services and merchandise exports fell 7.3 per cent year-on-year to $182.7 billion, while imports fell 10.2 per cent to $205.29 billion.

Barthwal also said India and Britain were expected to soon reach agreement on five contentious issues in their negotiations on a free trade agreement. They have been struggling to conclude their free trade talks because of differences on some tariff lines and investment protection rules.

India’s annual wholesale prices fell for the third successive month in June, mainly due to lower fuel and power prices, government data showed on Friday.

The wholesale price index (WPI) in June fell 4.12 per cent, compared with a 3.60 per cent decline estimated by economists in a Reuters poll. In May, it dropped 3.48 per cent. June wholesale price inflation is at the lowest level since September 2015.

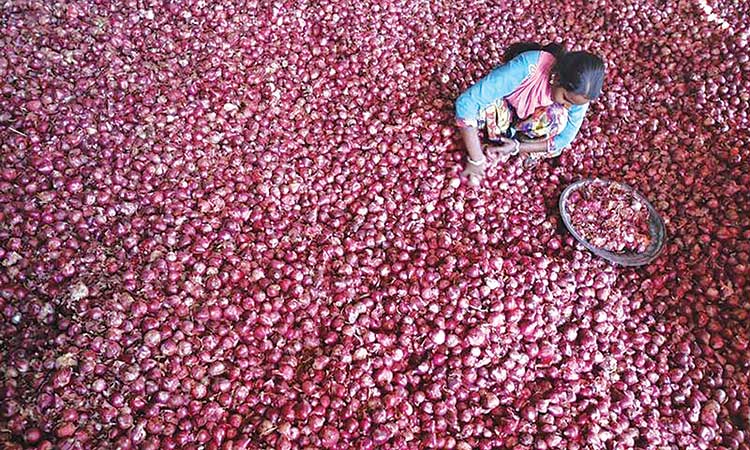

In June, fuel and power prices fell 12.63 per cent from a year earlier, compared with a fall of 9.17 per cent in May and prices of primary articles fell 2.87 per cent versus a fall of 1.79 per cent.

Food prices fell 1.24 per cent year-on-year, compared with 1.59 per cent in May, and manufactured product prices fell 2.71 per cent in June, against a 2.97 per cent fall the previous month.

However, inflation has started to accelerate in the South Asian country after showing signs of easing in the last few months.

Government data last week showed June retail inflation quickened to 4.81 per cent, higher than both the revised 4.31 per cent for the previous month and the 4.58 per cent expected in a Reuters poll of 55 economists, on the back of surging food prices.

Rupa Rege Nitsure, economist at L&T Finance Holdings, said deflationary pressures were expected to lessen going forward as food prices have started rising due to extreme weather events and uneven rainfall.

At its last meeting, the Reserve Bank of India kept interest rates on hold and economists do not expect the central bank to tinker with rates through 2023.

April’s wholesale price decline was revised to 0.79 per cent, from a fall of 0.92 per cent.

Meanwhile the macro picture has been bleak for the last two quarters, India’s private consumption, which dipped to $2.2 trillion in Q3-Q4 in FY23, is on its way up and expected to cross $2.4 trillion in the fourth quarter (Q4) of FY24, a report showed on Friday.

Indicators across emerging sectors, such as credit card spends, air travel and sales of vehicles, show signs of recovery in Q1 FY24 (April-June period), according to the report by Redseer Strategy Consultants.

The Indian macros are best positioned with a GDP of $6.5 trillion and a retail goods market size of $2 trillion, with the private final consumption expenditure (PFCE) at $4 trillion.

“The fundamentals are in the right place. Travel, financial services, recreation and insurance, among others, are ‘prosperity-driven categories’ and have experienced an acceleration,” said Mrigank Gutgutia, Partner, Redseer.

“India’s long-term consumption trends are gradually reflecting increased prosperity as the consumer behaviour evolves towards higher categories,” he added.

According to the report, India’s digital ecosystem is already at the gold standard with over 350 million active digital payment users, more than 50 million digital-using merchants and over 50 per cent digital ad share.

Other categories expected to accelerate with long-term growth, include education, personal vehicles, personal care, food, and clothing.

“Premiumisation, brand proliferation and digitisations being the core consumption themes across sectors. While the journey so far has been turbulent, India’s Internet is poised to be in cruise control momentum until the end of the decade at a 25 per cent CAGR,” the findings showed.

Although the total number of Internet transactors is 350 million, the mature Internet transactors who are frequent online buyers have plateaued around 40-45 million.