Keeping offshore wind projects on track

Representational image

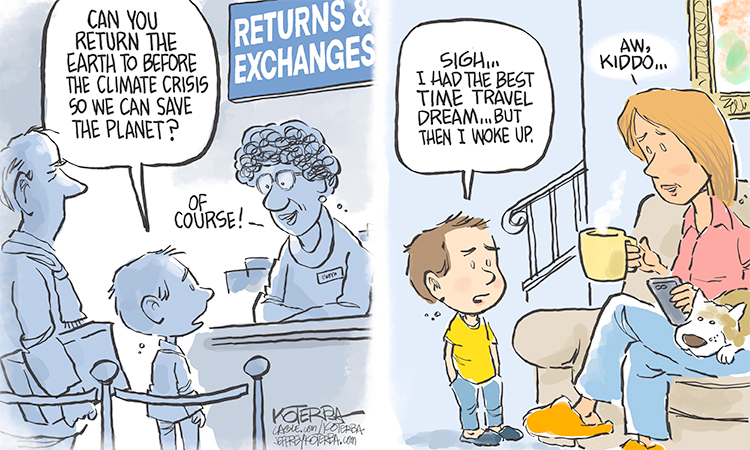

Many countries are relying on a huge and rapid build-out of offshore wind farms which have high upfront costs but over the longer term can provide cheaper energy than fossil fuel plants. But some countries’ wind power capacity targets started to look unrealistic this year after developers cancelled projects in the US and Britain because soaring costs made them unprofitable.

Investors told Reuters governments have since shown willingness to pay higher prices, helping to restore confidence in the future of the industry. “The reality is governments are starting to react and are accepting that to keep their offshore wind programmes on track – which are important for the economy, energy security, decarbonisation targets and jobs – it’s worth paying a bit more,” said Jonathan Cole, CEO of project developer Corio Generation.

Corio, along with TotalEnergies and Rise Light and Power, in October were successful in an auction held by New York State for their Attentive Energy One 1.4 gigawatt (GW) offshore wind project, part of a wider procurement of 6.4 GW of renewable capacity, enough to power around 2.6 million homes.

In Britain, the world’s second largest offshore wind market behind China, developers can bid for government-backed price guarantees for the electricity produced, called Contracts for Difference (CfDs).

If wholesale prices are lower than the so-called strike price agreed in the CfD, the government makes up the difference, giving project developers long-term revenue certainty. If prices are higher, the developer pays back the difference to the UK government.

Britain’s last auction in September failed to attract any offshore wind projects, with developers saying the guaranteed price on offer was too low.

Since then, the government has said it would offer contracts with a price 66% higher at the next auction due to be held in 2024. Analysts at Aurora Energy Research said the higher British contract price would mean that for a generic project, developers could generate returns of up to 13.9% compared with returns of just 4% achievable under the terms offered in the failed auction.

Offshore wind projects do have high upfront costs. Orsted’s 3 GW Hornsea 3 project, planned off the coast of Britain, is expected to cost around 8 billion pounds. Yet once the projects are built, they have no fuel costs and over the longer term provide a cheaper alternative to fossil fuels.

“In the longer-term we see countries with more wind and solar will have cheaper wholesale electricity prices than those relying more on fossil fuels,” said LSEG analyst Nathalie Gerl.

Despite the uncertainty created by the recent setbacks, investor appetite for offshore wind is strong, adds Reuters. Britain’s Octopus launched a dedicated fund with Japan’s Tokyo Gas (9531.T) to invest 3 billion pounds ($3.7 billion) in offshore wind projects by 2030. Germany’s RWE said it would raise its offshore wind capacity from 3.3 GW currently to 10 GW by the end of the decade. Governments too, it seems, recognise that it makes sense to stick with the technology as one of the fastest ways to rapidly scale up their renewable power and meet climate targets.

Soeren Lassen, head of offshore wind Research at WoodMac said more than 50 GW of offshore wind tenders globally are planned for 2024.

“It’s just a question of the policymakers making them attractive enough and for the industry to seize those opportunities,” he remarked.