Financial meltdown

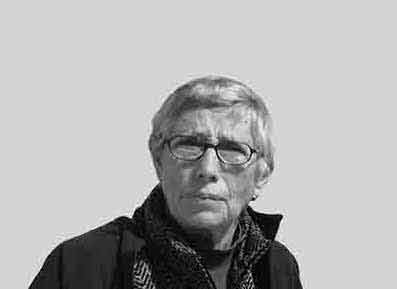

Michael Jansen

The author, a well-respected observer of Middle East affairs, has three books on the Arab-Israeli conflict.

Bassam al-Sheikh Hussein held a siege in a bank in Lebanon in a desperate attempt to access his money to help his sick father.

He is a desperate man who urgently needs thousands of dollars to pay for his father’s medical treatment. He is unable to withdraw the needed sum because his entire deposit has been blocked by the bank since the country’s financial melt-down began in 2019. Although withdrawals are meant to be approved for emergencies, his application was not only denied but he has also been unable to withdraw the permitted $400 in dollars and $400 in Lebanese Liras for two months.

As the scenario unfolded, hundreds of Lebanese, equally angry at their banks, gathered outside the Hamra Street Federal Bank branch in West Beirut and cheered Hussein. Social media posts lauded him and prompted people to join the throng. The bank agreed to his demands: to pay the demanded sum and not prosecute him for the hold-up which did not amount to a robbery. As security forces led him from the bank, he smiled waved to the cheering crowd. The bank honoured the first of his terms but not not the second. While behind bars awaiting criminal charges, his relatives blocked a main highway in Beirut to demand his release and he staged a hunger strike in protest at his detention.

According to al-Jadeed television, his lawyer told interrogators that Hussein did not point his gun at the hostages and had no intention of harming bank employees. However, the judge dealing with his case placed Hussein under arrest since he committed the crimes of hostage taking and threatening them with weapons. If convicted, he could serve prison terms of several months or two-to-three years.

The Lebanese judiciary and security services may make an example of Hussein because he is not the first to take hostages in a bank to demand his money. In January, the owner of a coffee shop in a eastern Bekaa town took bank employees hostage and threatened to kill them until he was allowed to withdraw $50,000. He was jailed, not charged, and was released two weeks later. The Lebanese authorities do not want any more copycat hostagings in banks. Freeing Hussein could lead to more such incidents. Unfortunately, as soon as Hussein was arrested, his hero status melted away like the grin on the face of the Cheshire Cat in Lewis Carroll’s “Alice in Wonderland.” His admirers are not fickle but are constantly challenged and stressed by the hourly and daily struggles they face over life-preserving food, water, fuel, electricity, and medicine.

Since Lebanon’s economic collapse began three years ago, the economy has shrunk by 58 per cent, the value of the currency has fallen by 90 per cent, and 80 per cent of Lebanese have slipped below the poverty level, an addition of 50 per cent. The World Bank has dubbed Lebanon’s collapse as one of the World’s worst economic crises since 1850! Yes, 1850!

Hussein is a victim of the both bankers and politicians who the World Bank says deliberately brought the country to its knees and caused the distress of its citizens. His story is also typical of the financial experiences of his countrymen and women.

The country’s economic mismanagement began in the wake the 1975-90 civil war. At that time successive governments borrowed heavily from abroad for the reconstruction of Beirut’s central banking and business district. Lebanon was kept afloat by tourism revenues and foreign remittances until 2011 when Arab Spring instability reduced the inward flow of dollars while Lebanon continued to rely on imports for necessities, running down foreign currency reserves. While interest rates had been high for years, encouraging residents and expatriates to deposit in the banks, in 2016, the rates became 8 per cent for dollar deposits and 12 per cent for Lebanese Lira deposits. Hundreds of thousands of Lebanese, including Hussein, took the bait.

Eager to benefit from the high interest rate for dollars, Hussein sold his house and his parents’ house and deposited the money in the Federal Bank. A food truck driver with limited means, he all too clearly thought his capital would grow and his family would be better off. Lebanese from all levels of society were caught in what the World Bank called the Lebanese banking sector’s ponzi scheme. A Harvard graduate academic friend of mine changed dollars into Lebanese Liras due to the high interest: the exchange rate at the time was 1,500 Liras to the dollar but has recently become 27,000-38,000 to the dollar. My friend’s savings are worth nothing.

A Ponzi scheme lures clients by paying excessive interest rates and profits to early investors with funds from recent investors rather than profits from legitimate investments. While operators can pay back early investors, later investors lose their money. In Lebanon’s case, wealthy Lebanese and politicians transferred billions of dollars abroad at the first sign of economic weakness, leaving the banks without funds to pay the majority of depositors as well as for essential imports. While Lebanon is bankrupt and an international debtor, the politicians and bankers who put the country in jeopardy have done nothing to remedy the situation. The politicians squabble over the formation of a new government following the May 15th parliamentary election which effected little change in the membership of the legislature and brought no relief to stressed Lebanese.

Photo: AP