ADCB reports pre-merger net profit at Dhs1.152b for 1st quarter

The results are for the standalone ADCB entity for Q1, prior to merger with UNB and acquisition of Al Hilal Bank.

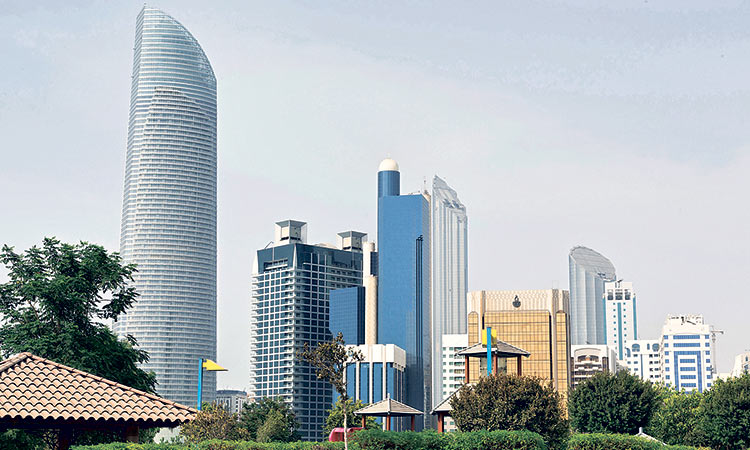

The Abu Dhabi Commercial Bank (ADCB) on Monday reported its financial results for the first quarter of 2019. The results are for the standalone ADCB entity for the first quarter of 2019, prior to the merger with Union National Bank and the subsequent acquisition of Al Hilal Bank.

According to the bank annoucement, strong operating performance underpinned by robust growth in gross interest and Islamic financing income and non-interest income.

Gross interest and Islamic financing income of increased 17 per cent at Dhs3.116 billion; net interest and Islamic financing income hit Dhs1.707 billion; non-interest income rose 8 per cent at Dhs566 million.

Net fees and commission income also went up by 8 per cent at Dhs379 million, while, operating expenses went up three per cent at Dhs793 million, mainly attributable to ongoing investments in digital transformation initiatives and integration related expenses.

Impairment allowances of Dhs330 million were 13 per cent lower as well as net profit of Dhs1.152 billion was also 5 per cent lower, impacted by higher cost of funds, partially offset by higher non-interest income and lower impairment charges.

Customer deposit growth continued to outpace loan growth. Total assets grew 4 per cent to Dhs292 billion and net loans to customers increased 2 per cent to Dhs169 billion over December 31, 2018.

Deposits from customers increased 4 per cent to Dhs184 billion over December 31, 2018. Low cost CASA (current and savings account) deposits increased by Dhs10 billion to Dhs80 billion over December 31, 2018 and comprised 43.3 per cent of total customer deposits compared to 39.4 per cent as at December 31, 2018

Loan to deposit ratio improved to 91.7 per cent from 94.2 per cent as at December 31, 2018.

Capital adequacy ratio (Basel III) of 15.76 per cent and common equity tier 1 (CET1) ratio of 12.07 per cent compared to minimum capital requirements of 13.50 per cent and 10.00 per cent (including buffers) respectively prescribed by the UAE Central Bank

Liquidity coverage ratio (LCR) of 193 per cent compared to a minimum ratio of 100 per cent prescribed by the UAE Central Bank (LCR as at December 31, 2018: 186 per cent compared to a minimum ratio of 90 per cent prescribed by the UAE Central Bank). Liquidity ratio of 30.3 per cent compared to 28.3 per cent as at December 31, 2018.

Net lender of Dhs16 billion in the interbank markets

On 1 May 2019, ADCB combined with Union National Bank (UNB) and Al Hilal Bank to form a larger and stronger banking group called ADCB. Al Hilal Bank continues to operate as a separate Islamic banking entity within the group under its own brand, mainly providing Shari’ah-compliant retail banking products and services through digital platforms.

The Bank’s operations, processes and infrastructure will be integrated in phases over the next 18 to 24 months. The combination is expected to deliver annual cost synergies of approximately Dhs615 million. ADCB will continue to keep the market fully apprised of progress with the integration.

Commenting on the bank’s performance, Ala’a Eraiqat, Group Chief Executive Officer and Board Member said: “Following our strong results in 2018, we are pleased to announce a net profit of Dhs1.152 billion in Q1’19. We have made good progress in a number of key areas in the first quarter of 2019. In particular, we have delivered a strong and sustainable return on equity, increased fee income and continued to grow our market share in deposits. In a rising interest rate environment, our low cost CASA deposits grew by Dhs10 billion to Dhs80 billion, reporting an increase of 15 per cent over the year end.

The Bank maintains a robust risk governance structure. Our prudent approach to risk management has given us the flexibility to adjust to the challenges of the operating environment in an increasingly competitive market. We remain committed to preserving and protecting the long-term financial strength of the Bank and continue to place high priority on maintaining adequate sources of funding and liquidity.

Fast-paced changes in technology continue to impact customers’ expectations and behaviour, and the Bank’s strategy is evolving in parallel to maintain our position as a progressive player. We have sustained our investment in digital transformation, with key initiatives such as the recent launch of the “Hayyak” onboarding app for new customers, which offers instant account opening.”

Deepak Khullar, Group Chief Financial Officer, commented on the results: “We have delivered a strong set of results in the first quarter of 2019. The Bank’s fundamentals remain solid. Bottom line was impacted by higher cost of funds underpinned by a conscious decision to increase long term time deposits and wholesale funding to meet the evolving regulatory liquidity requirements.