Abu Dhabi realty sector records Dhs46 33b transactions in H1

The department’s half-yearly report indicates that all kinds of land, buildings, and real estate were purchased, sold, and mortgaged.

The department’s half-yearly report indicates that all kinds of land, buildings, and real estate were purchased, sold, and mortgaged.

DMT’s real estate trading index shows 6,730 real estate purchase and sale transactions worth Dhs25.09 billion and 3,827 mortgage transactions worth Dhs21.24 billion.

Dr Adeeb Al Afifi, Executive Director of the Real Estate Sector at the DMT, said, “Abu Dhabi’s real estate market continues to thrive, showcasing a resilient and optimistic investor sentiment. The recently released report by the DMT reaffirms our market’s enduring appeal and solid growth potential, positioning Abu Dhabi as an attractive destination for local and global investors.”

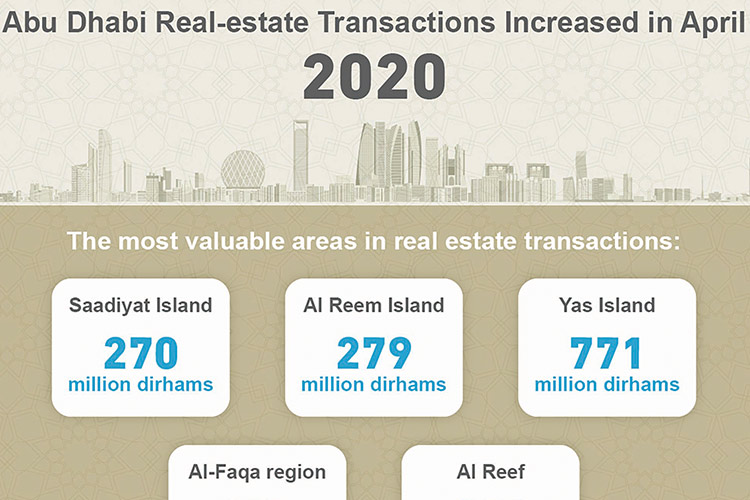

In the list of top five areas in terms of the numbers and values of real estate transactions in Abu Dhabi during the first six months of 2023, Al Saadiyat Island topped the list with transactions worth Dhs3 billion, with Yas Island coming in at second place with transactions worth Dhs2.6 billion.

With Dhs2.4 billion, Al Reem Island came in third, Al Jubail Island came in fourth with Dhs1.5 billion, and Al Shamkha City came in fifth with Dhs1 billion.

Dr Al Afifi said, “As we enter the second half of 2023, we expect to see significant investment opportunities, particularly with the introduction of several new projects that will boost Abu Dhabi’s real estate market.”

Diverse investors from the UAE, GCC, and around the world have continued to boost the emirate’s real estate market.

The Department of Municipalities and Transport announced recently that foreign direct investment (FDI) in the individual category within Abu Dhabi’s real estate sector has soared to Dhs834.6 million during the first half of 2023, achieving a record growth rate of 363% compared to the corresponding period last year.

According to data released by the DMT, the following five regions topped the list in terms of the highest shares of foreign direct investment by individuals: Saadiyat Island with 34%, Yas Island with 28%, Al Jurf with 12%, Al Reem Island with 11%, and Al Shamkha area with 8%.

Dr Adeeb Al-Afifi said: “We are thrilled to announce the remarkable surge in foreign direct real estate investments in Abu Dhabi. The astounding 363% growth witnessed during the first half of this year is a testament to the emirate’s exceptional appeal to foreign investors. This includes its strategic location, world-class infrastructure, and supportive economic and legislative environment, all of which have contributed to enhancing the emirate’s position as a preferred destination for individuals of all nationalities to invest, live, and work.

Dr Al-Afifi further added, “Abu Dhabi’s investment climate has created a nurturing and stimulating environment for foreign investors pursuing promising prospects in the real estate market. Moreover, the emirate’s commitment to adopting sustainable development policies, innovation, economic diversification, and environmental sustainability has significantly enhanced its ability to attract foreign direct real estate investments.”

The real estate sector in Abu Dhabi has continued its growth trajectory in the first quarter of this year, with 5,472 property sales and mortgages recorded worth Dhs27.9 billion, compared to 3,304 transactions worth Dhs11.3 billion during the same period in 2022, according to official data released by the Department of Municipalities and Transport (DMT).

The value of real estate transactions in Abu Dhabi during Q1 2023 has increased by 147% compared to the same period last year, while the number of transactions has risen by 66%. The real estate indicators released by DMT showed that the sector has recorded 3,518 buying and selling transactions of properties worth Dhs16.2 billion, compared to 1,722 transactions worth Dhs4.4 billion during the first quarter of last year, indicating an increase in the total value of property sales by 268% and an increase in the number of transactions by 104%.

In addition, the DMT has recorded a significant increase in the value and number of mortgage transactions during this period, with 1,954 mortgages recorded worth Dhs11.7 billion between January and March 2023, compared to 1,582 transactions worth Dhs6.9 billion during the first quarter of last year, reflecting an increase in the value of transactions by 70% and an increase in the number of transactions by 24%.

During the first quarter of this year, there were 1,769 new investors in these transactions, which is a 42% increase compared to the 1,244 new investors in the first quarter of last year. Additionally, the percentage of non-resident investors during this period was 10.71%, a 75% increase from the 6.10% of non-resident investors in the first quarter of last year.