Oil markets are going through ‘great fluctuations’, says Opec

President Joe Biden leaves St. Joseph on the Brandywine Catholic Church in Wilmington, Del., after attending a Mass on Sunday. Associated Press

Al Ghais added that the goal of Opec and producers outside the organisation is to maintain market stability. Oman’s energy ministry said on Sunday that Opec+ decisions are based on purely economic considerations, realities of supply and demand in the market.

The Opec+ decision to cut oil production by 2 million barrels per day “is in line with the group’s previous decisions in terms of being based on market data and its variables”, and it was important and necessary to reassure the market and support stability, the ministry added.

The ministry added that the decision was necessary to reassure the market and stabilise it.

The 13-member Organization of the Petroleum Exporting Countries and its allies, which include Russia,

lowered its production target by 2 million barrels per day when they met on Oct. 5.

The move came despite fuel markets remaining tight, with inventories in major economies at lower levels than when Opec has cut output in the past.

Iraq’s Oil Marketing Company (SOMO) said on Sunday that Opec+ decisions are based on economic indicators and are taken unanimously.

“There is complete consensus among Opec+ countries that the best approach in dealing with the oil market conditions during the current period of uncertainty and lack of clarity is a pre-emptive approach that supports market stability and provides the future the guidance it needs,” SOMO said in a statement.

Bahrain’s oil minister said on Sunday that the Opec+ decision to cut oil output by 2 million barrels per day was taken unanimously and after a thorough technical study of the global market conditions and developments, state news agency (BNA) reported.

Member states are keen to take decisions that aim to stabilise oil markets, and the group will study any economic developments to ensure the stability of global markets and supplies, and the balance between the interests of producers and consumers, the minister added.

Algeria’s energy minister said Opec’s latest decision to cut output was “historic” and aims to stabilise markets, Ennahar TV reported on Sunday.

Energy minister Mohamed Arkab, and Opec Secretary General Haitham Al Ghais expressed their full confidence in the organisation’s decision, according to the report.

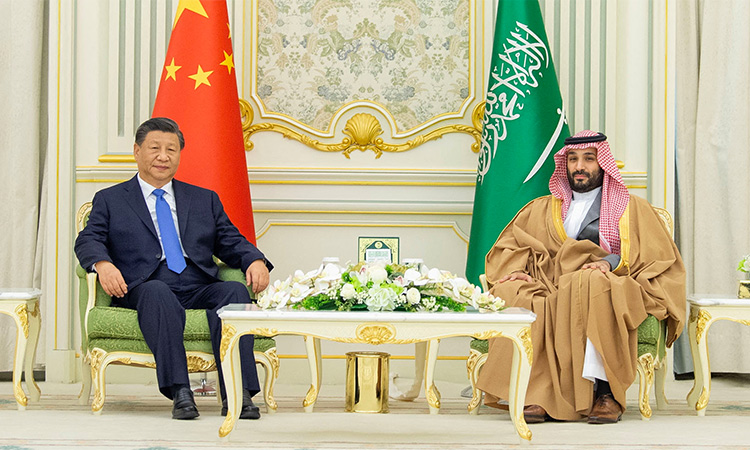

Meanwhile, President Joe Biden has “no plans” to meet with Saudi Crown Prince Mohammed bin Salman at an upcoming G20 summit in Indonesia, US National Security Advisor Jake Sullivan said on Sunday.

Gut-wrenching market volatility and attractive valuations are prompting some investors to keep their bullish views on energy stocks, one of the few bets that have thrived in an otherwise punishing year.

It’s not an easy call. The S&P 500 energy sector is already up around 46% this year and monetary policy tightening around the world has bolstered the chances of a global recession that could curtail energy demand.

Still, signs that supply will remain comparatively scarce are prompting some investors to stick with the sector, drawn by attractive earnings prospects and valuations that remain comparatively low despite big gains in many energy stocks this year. The S&P 500 energy sector trades at a trailing price-to-earnings ratio of 9.9, nearly half the 17.4 valuation of the broader index.

Few also see any end to the selloff in broader markets, as stubborn inflation boosts expectations for more market-punishing rate hikes from the Federal Reserve and other central banks. The S&P 500 is down around 24.5% this year while bonds - as measured by the Vanguard Total Bond Market index fund - are down nearly 18%.

“It’s hard to see people giving up on energy because it’s the best of both worlds,” said Jack Janasiewicz, portfolio manager with Natixis Investment Managers Solutions, referring to the sector’s low valuation and potential for more gains if supply remains tight. “If you’re worried about the direction of the market it’s a great place to hide.”

Analysts expect third-quarter earnings per share growth for energy companies of 121% compared with the same period a year ago, while those for the broader index excluding energy fall 2.6%, Refinitiv data showed.

Energy is the only sector in the S&P 500 expected by analysts at Credit Suisse to post positive revisions to their third quarter earnings. U.S. oil giants Exxon Mobile Corp and Chevron Corp. report earnings on Oct. 28.

In the coming week, investors will be focused on earnings from Tesla Inc., Netflix and Johnson & Johnson , among others.

Expectations for further tightness in the oil market have been boosted by recent production cuts by Opec+, as well as the European Union’s plans to move off Russian crude by February.

US output in 2022 is expected to average 11.75 million bpd, down from a previous estimate of 11.79 million bpd, according to the US Energy Department.

Prices for Brent crude stood at $91.46 per barrel on Friday, up nearly 10% from a recent low after falling by nearly a third between July and September.

Agencies