More caution than courage in India budget

India's Finance Minister Nirmala Sitharaman gestures during a photo opportunity in New Delhi, India. Reuters

Among the promises are a plan to infuse capital worth $10 billion and provide a partial one-time guarantee on loan defaults on borrowings by shadow banks to help state-run banks, steps to replicate zero-budget farming practised in a few states in all of India and incentive on purchase of electric vehicles.

Sitharaman also proposed giving foreign investors a bigger role in the insurance and aviation sectors. For employment generation, the government intends to boost agro-rural industries through cluster-based development with a focus on bamboo, honey and khadi clusters.

However, what Prime Minister Narendra Modi hailed as a “new chapter for India,” has also raised doubts whether the measures announced are enough to offset severe challenges, including weak monsoon rains, debt-burdened banks and global tariff wars.

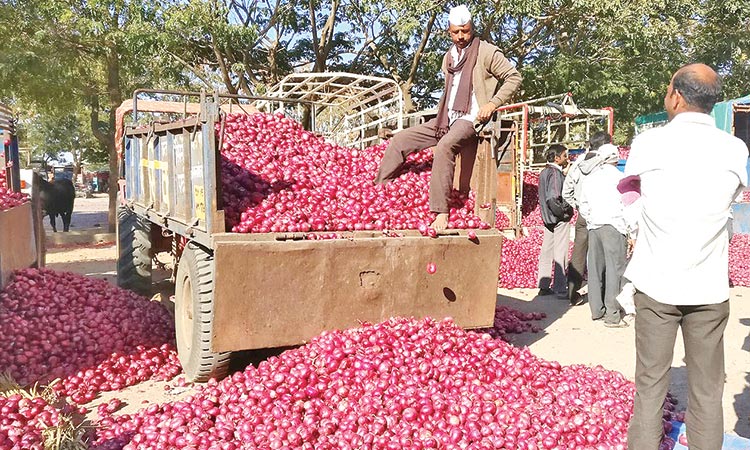

A shortfall in monsoon rains is a huge concern, as the farm sector that employs nearly half of India’s working population is completely dependent on it. Any shortfall or untimely rains could lead to massive losses in crops and reduce farm incomes.

Besides, the government did not announce a big jump in public spending, contrary to expectations.

The Indian economy has already been weakening sharply in the past year. In the fourth quarter of the fiscal year to last March 31, economic growth slumped to 5.8%, the slowest pace in 20 quarters.

Growth for the full year ended in March was 6.8%, also a five-year low.

Plunging industrial output and low automobile sales have added to fears of a deeper slowdown.

India is ranked as the world’s sixth-biggest economy just behind Britain and ahead of France. The US and China occupy the first and second spots with $19 trillion and $12 trillion.

Moody’s has stated in a research note that achieving a lower fiscal deficit while maintaining support for growth and incomes would be “very challenging.” The economy is expected to grow relatively slowly, despite the government’s income support measures.

The government also increased local levies on a litre of petrol and diesel by two rupees each and this has stoked fears of inflation.

It’s not glittering news on the gold front. Domestic gold prices in India jumped to a record on Friday following an unexpected increase in import duty in the country’s budget, hitting demand and forcing dealers to offer the highest discount in nearly three years.

Dealers in India, the world’s second biggest gold consumer after China, were offering discounts of up to $30 an ounce, the highest since August 2016, over official domestic prices, versus the $25 discounts seen last week.

Increased taxes on the rich to hold down the fiscal deficit may not see much opposition.

The budget has failed to enthuse the Indian community in the UAE as there is nothing much to talk about, except a proposal to allow non-resident Indians to have Aadhar Card.

The budget proposes to consider issuing Aadhaar Card for non-resident Indians with Indian passports after their arrival in India. As of now, they have to wait for 180 days.

What is needed is brave reforms, including freeing up land and labour markets, which Modi shied away from in his first term fearing political repercussions. This time around too, the budget proposals reflect more of caution than courage.