FTA posts over 110% growth in number of authorised agents

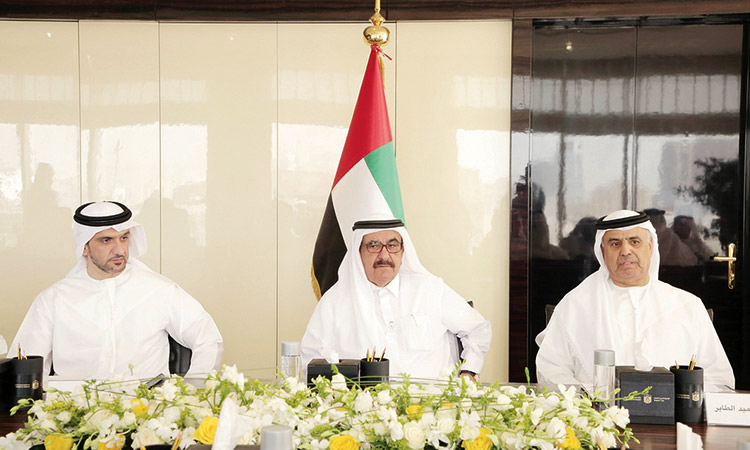

Khalid Ali Al Bustani addresses tax agents in a meeting in Dubai.

The first half of 2019 saw the number of authorised Tax Agents increase by more than 110 per cent to exceed 370 Agents, up from 176 by the end of 2018, asserted the Federal Tax Authority (FTA) as it hosted the second Meeting of Tax Agents.

The Authority noted that the growth in the number of authorised Agents provides a wider array of options for Taxable Persons who choose to deal with the Authority via an Agent, where they can select from a long and continuously updated list of registered Agents. This, in turn, promotes self-compliance among businesses as it offers them counsel and support to carry out their tax obligations.

FTA Director General Khalid Ali Al Bustani inaugurated the meeting, which was attended by all 370 Tax Agents. The FTA had organised the meeting as part of its plan to maintain continuous communication with its strategic partners, as well as to introduce its development plans, and offer a platform to explore opinions and suggestions for encouraging Taxable Persons to self-comply.

Al Bustani called on Tax Agents to abide, in all their transactions, by the professional principles set by the Authority, which adhere to high international standards.

“These periodic meetings truly embody the effective collaboration between government entities and the private sector, who work together for the greater good and elevating the national economy,” he said, underlining the important role that Tax Agents play in the success of the tax system. “This profession requires advanced academic requirements and extensive experience. Tax Agents registered with the Authority are enlisted by an individual or entity to represent them with the FTA and help them fulfil their obligations and secure their rights.”

Al Bustani noted that the Authority has published a series of guides and e-learning modules on its website, covering the legislative and executive aspects of the tax system. The FTA Director General urged Tax Agents to benefit from these publications and study them extensively to improve knowledge of the UAE tax system among all those active in the sector, which, in turn, leads to better services and ensures a smooth and successful implementation of tax legislation and procedures.

The meeting saw FTA representatives introduce participants to several important topics directly related to their field of work, including registration requirements, professional standards that Tax Agents are expected to meet, and the procedures that the Authority carries out to monitor Agents and evaluate their adherence to its standards. The FTA experts then answered queries from attendees and listened to their suggestions.

The Authority asserted that a Tax Agent’s profession requires advanced qualifications, know-how, competencies and practical experience in order to be able to perform their role with accuracy, and to meet stringent standards. Tax Agents registered with the FTA can be assigned to any person or entity for the purpose of representing them with the Authority, and assisting them in carrying out their obligations and exercising their tax rights.

The Federal Tax Authority has already accredited a large number of Tax Agents who met the technical standards, conditions and qualifications required, and passed the exams prepared by the FTA to determine their ability to carry out their mandate, and help the business sectors comply with their tax obligations.

The Federal Tax Authority has outlined seven mandatory basic standards that must be met by candidates applying for the Tax Agents’ registry, including having a Bachelor’s or Master’s degree in tax, accounting, or law from a recognised educational institution; or a Bachelor’s degree in any other field, as long as the candidate holds a certificate from an accredited international association specialising in taxation; in addition to at least three years of practical experience in the field of taxation, legal accounting, or law. He or she must be fluent in both Arabic and English with verbal and written skills, and meet all the qualification standards set by the Authority.

The Federal Tax Authority was established by Federal Decree-Law No. (13) of 2016 to help diversify the national economy and increase non-oil revenues in the UAE through the management and collection of federal taxes based on international best practices and standards, as well as to provide all means of support to enable taxpayers to comply with the tax laws and procedures. Since its inception in 2017, the FTA has been committed to cooperate with the competent authorities to establish a comprehensive and balanced system to make the UAE one of the first countries in the world to implement a fully electronic tax system that encourages voluntary compliance, with simple procedures based on the highest standards of transparency and accuracy – beginning from registration, to the submission of tax returns, to the payment of due taxes through the Authority’s website: www.tax.gov.ae