ADX to boost best practices for sustainability globally

Abu Dhabi Securities Exchange organised two sustainability reporting workshops.

The initiative is one of the pivotal axles of Abu Dhabi Securities Exchange (ADX’s) broader programme to advance international best practices for sustainability across the Emirate, in line with the issuance of the Environmental, Social, and Governance (ESG) Disclosure Guidance for listed companies in July of this year.

Representatives from ADX and a leading institute in the filed participated in the workshops, which were attended by 80 individuals representing 61 listed companies. The two sessions reviewed practical ways to incorporate sustainable practices in business operations, and a step-by-step guide to ESG reporting procedures was provided, including the calculation and measuring of standards.

Khalifa Salem Al Mansouri, Chief Executive of ADX, commented: “ADX is working with listed companies in order to enhance market competitiveness and attract a greater degree of global sustainable investments to the Emirate of Abu Dhabi. ADX’s advocating of sustainability practices supports the national economic strategy through providing a transparent, fair and sustainable trading environment. Organising these workshops for ADX-listed companies is part of our broader strategy to filter ESG principles across all of our market operations. A strategy designed to make ADX performing with a sense of anticipation and responsibility”

Another crucial aspect covered in the seminars was the strategic importance for companies of assimilating environmental and social standards, with increasing global investment trends towards companies that apply such principles at the heart of their corporate governance. The ESG benchmarks of successful listed companies was illustrated and the ways in which the disclosure of these standards is beneficial, including a positive impact on returns which reduces losses, risks and related damages.

The Environmental, Social, and Governance (ESG) Disclosure Guidance report issued by ADX earlier this year was published in order to inspire responsible investment practices, as well as encourage dialogue between investors and listed companies. Furthermore, this report outlined sustainable and environmentally-friendly ADX financial products such as green bonds and the environmental, social, and governance indicators.

Companies that release a sustainability report in Abu Dhabi should adhere to ADX’s index indicators that are aligned with the Global Reporting Initiative and SDG indicators, including 31 KPIs that form the Environmental, Social, and Governance (ESG) Disclosure Guidance rules. This guidance is in line with recommendations from the Sustainable Stock Exchange Initiative (SSE), the World Federation of Exchanges (WFE), the Global Reporting Initiative (GRI) and the Integrated Reporting Framework.

Each indicator covers an aspect of the ESG and calculates equations accordingly, with companies provided with the ability to monitor and track these to discover the resulting positive trends from deeper investment. Disclosure through sustainability reports opens the door to investments from institutional and individual investors who apply environmental and social standards - investments which are estimated to be worth $83 trillion worldwide.

The workshop exemplifies ADX’s active role in supporting the government’s actions towards positive economic, social and environmental outcomes. For ADX the objective is to proactively imbed sustainability concerns in every dimension on investment strategies and accompanies the transition to a new sustainable development paradigm.

Abu Dhabi Securities Exchange (ADX) was established on November 15 of the year 2000 by Local Law No. (3) Of 2000, the provisions of which vest the market with a legal entity of autonomous status, independent finance and management. The Law also provides ADX with the necessary supervisory and executive powers to exercise its functions.

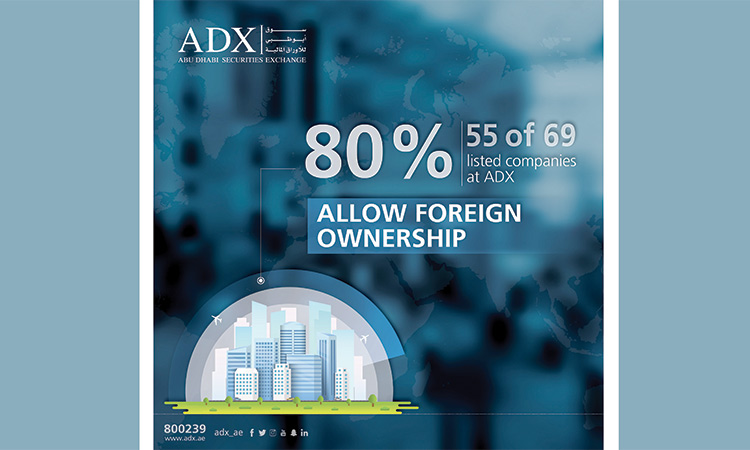

ADX is a market for trading securities; including shares issued by public joint stock companies, bonds issued by governments or corporations, exchange traded funds, and any other financial instruments approved by the UAE Securities and Commodities Authority (SCA).

In 2014, ADX was upgraded to ‘Emerging Market’ status by both MSCI and S&P Dow Jones. ADX was already classified as an Emerging Market by FTSE in 2009 and in 2011 by S&P and Russell Investments.

Abu Dhabi Securities Exchange (ADX) formerly Abu Dhabi Securities Market (ADSM) is a stock exchange in Abu Dhabi, UAE. It was established on Nov.15, 2000 to trade shares of UAE companies.

WAM/Agencies