US index funds not supporting proposals on ‘saving climate’

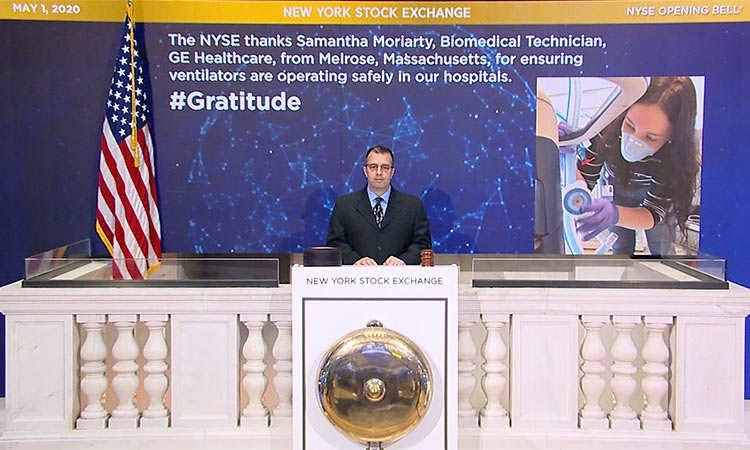

Officials of BlackRock during a function at the New York Stock Exchange. Reuters

While votes on climate-related shareholder resolutions often take centre stage at corporate annual meetings, they seldom draw support from the two top US index fund firms, BlackRock and Vanguard Group. The reticence of the two largest index fund providers to back these proposals draws criticism from some investors and climate activists.

BlackRock sometimes criticises the quality of the climate-change proposals offered by others, but the world’s largest money manager and its top rivals have not put forward any proposals of their own since at least 2001, according to research firm FactSet.

“The investors who should be the leaders have so far been the laggards,” said Rob Berridge, director of shareholder engagement at Ceres, a Boston-based research and advocacy group focused on sustainability issues.

Their limited support for other shareholders’ climate-related proposals highlights a broader pattern of deference to management at the companies in their stock portfolios, according to a Reuters analysis of their proxy voting records.

Ahead of shareholder meetings in 2017, investors led by Walden Asset Management filed resolutions with Blackrock and Vanguard calling for reviews of their proxy voting related to climate change. Walden later withdrew the resolutions after BlackRock and Vanguard each pledged to put a new focus on climate risks.

But in 2018, BlackRock and Vanguard only backed 10% and 12%, respectively, of climate-related shareholder resolutions, according to a count by Ceres. A Reuters review of proxy voting disclosures for the 2019 proxy season ended June 30 found similar rates of support by each manager for key votes tracked by Ceres this year.

Those rates were less than Walden and other investors expected given the companies’ pledges to take the issue more seriously, said Tim Smith, a director at the firm now known as Boston Trust Walden, a money manager focused on environmental and social issues. The top index fund firms say they prefer to address issues they have with portfolio companies, including those related to climate change, in private talks with executives rather than through shareholder votes. Vanguard governance chief Glenn Booraem said such votes don’t tell the whole story of its advocacy on climate issues. In an August report, Vanguard said it had met often with companies in carbon-intensive industries over the past year and discussed issues such as environmental risks and their impact on shareholder value.

Vanguard and BlackRock both declined to discuss their votes on specific proxy measures. They note their own investors hold a wide range of opinions on climate change.

BlackRock told a large Seattle pension plan client in 2018 that it often finds shareholder proposals too prescriptive, immaterial or in the domain of a company’s leadership.

“We typically aim to understand the companies rather than use our vote as a blunt binary instrument,” BlackRock said in response to due diligence questions from the Seattle City Employees’ Retirement System (SCERS).

The third largest index fund manager, State Street Corp , supported the resolutions tracked by Ceres 34% of the time in 2018. The rate was about three times as often as its big index fund rivals and similar to the support rate of other big investors such as Charles Schwab Corporation and Franklin Templeton, part of Franklin Resources.

State Street spokeswoman Olivia Offner declined to discuss individual votes but said in a statement that companies have responded to its concerns on issues including “improved disclosure on their sustainability practices.”

Some clients say BlackRock and Vanguard effectively press their concerns privately. They also cite efforts like the annual letter that BlackRock Chief Executive Larry Fink sends to other CEOs, in which he has raised topics including how environmental and social issues affect corporate valuations. “There’s always room for improvement, but they’re taking it seriously and doing a much more proactive job” of pressuring companies on climate and other issues, said Vermont Chief Investment Officer Eric Henry, speaking about top index fund firms. He oversees about $4.5 billion, including assets managed by BlackRock.

Reuters