India’s retail inflation softens in July to 3.15% on lower fuel prices

The marginal dip in the CPI inflation in July was led by fuel and light, which recorded a disinflation. Reuters

According to the National Statistical Office (NSO) data, the consumer food price index (CFPI) increased 2.36 per cent in July against 2.25 per cent in June and 1.30 per cent in July 2018.

Among the non-food categories, the fuel and light segment’s inflation declined year-on-year to (-) 0.36 per cent in July.

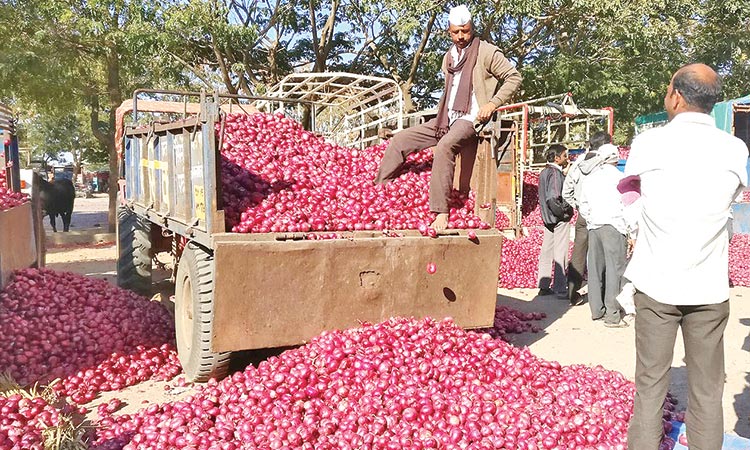

Prices of vegetables, eggs, meat and fish pushed the retail inflation up year-on-year. Vegetables’ prices increased 2.82 per cent, meat and fish 9.05 per cent, eggs 0.57 per cent and pulses and its products 6.82 per cent.

However, at (-) 2.11 per cent decline in prices of ‘sugar and confectionery’ capped the food inflation.

Prices of milk-based products rose 0.98 per cent, cereals and its products 1.31 per cent. The food and beverages sub-category recorded 2.33 per cent rise in the month over July 2018.

The marginal dip in the CPI inflation in July was led by fuel and light, which recorded a disinflation, even as food and core inflation inched up, said Icra’s Principal Economist Aditi Nayar.

“The incoming trends in food prices need to be cautiously watched following the recent flood in some states, rising vegetable prices and continued lag in kharif sowing. Moreover, unfavourable base effect is likely to contribute to hardening of food inflation in the ongoing quarter,” Nayar said.

“At present, we expect the CPI inflation to inch up in the next two months, while remaining below the MPC target of 4 per cent in Q2FY20. The consumer price index (CPI) trajectory may allow for a 15 bps rate cut in October, after monsoon related uncertainties get resolved, especially if crude oil and other commodity prices remain relatively soft,” Nayar said.

According to Madhavi Arora, Economist, Edelweiss Securities, “The uptick in July was backed by sequential uptick in food components, led by fruits and vegetable. The core inflation also increased sequentially after contracting the previous month, led by education and housing.” “We think the food inflation seasonal uptrend will likely continue in the near-term, especially with uneven monsoon and possible flood disruption.” Joseph Thomas, Emkay Wealth Management head of research, said, “Retail inflation remains subdued with most components indicating not much variation compared with the earlier periods.” “But we need to make allowance for factors, like cheaper rupee, loss of crops due to rains and the consequent effects on prices, while trying to judge the future inflation,” Thomas said.

Lower prices of key transportation fuels along with food articles eased India’s annual rate of inflation based on wholesale prices to 1.08 per cent in July from 2.02 per cent in June.

Similarly, on a year-on-year (YoY) basis, the Wholesale Price Index (WPI) data furnished by the Ministry of Commerce and Industry showed a decelerating trend as inflation had risen to 5.27 per cent during the corresponding period of 2018.

“The annual rate of inflation, based on monthly WPI, stood at 1.08 per cent (provisional) for the month of July, 2019 (over July, 2018) as compared to 2.02 per cent (provisional) for the previous month and 5.27 per cent during the corresponding month of the previous year,” the Ministry said in its review of “Index Numbers of Wholesale Price in India” for July.

“Build up inflation rate in the financial year so far was 1.08 per cent compared to a build up rate of 3.1 per cent in the corresponding period of the previous year.”

Lower inflation rates along with hopes of an easing in US-China trade tensions and attractive valuations lifted the Indian equities market during mid-afternoon trade on Wednesday.

The S&P BSE Sensex gained 402.18 points, or 1.09 per cent, to 37,360.34 points at 2.45 p.m. It opened at 37,233.50 points and touched an intra-day high of 37,473.61 and a low of 37,000.77 points. Similarly, the NSE Nifty50 rose 112.15 points, or 1.03 per cent, to 11,038 points.

On Tuesday, the Sensex tanked 623.75 points due to a global sell-off after massive protests in Hong-Kong, heightened trade-tensions between the US and China and weakening of the Indian Rupee.

Healthy buying was seen in automobile, capital goods and banking stocks, whereas selling pressure was seen in the healthcare sector.

“Indian equity markets and currency are doing well on Wednesday following Asian stocks joining a global equities surge after Washington delayed tariffs on some Chinese imports,” HDFC Securities’ Research Head Deepak Jasani told IANS.

“Delaying of tariffs on some Chinese imports by the US has raised hopes of improvement in the economic growth scenario, globally.” Besides, the lower than expected wholesale price index reading for July raised hopes of a central bank rate cut in October, Jasani added.

Indo-Asian News Service