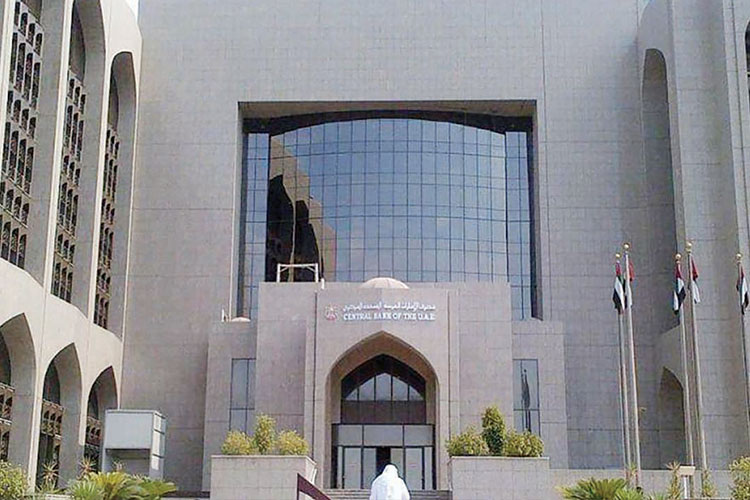

CBUAE issues new regulation to support digital payments

The UAE Central Bank is confident that the new regulation will strengthen public’s confidence in digital services.

Business Bureau, Gulf Today

In an effort to ensure that stored value products and services are operated in a secure, sound and efficient manner in the UAE, the Central Bank of the UAE, CBUAE, has issued a new regulation on Stored Value Facilities, SVF.

By introducing this new regulation for the providers of SVFs, the CBUAE aims to facilitate FinTech firms and other non-bank payment service providers easier access to the UAE market while continuing to safeguard the customers’ funds, ensure proper business conduct and support the development of payment products and services.

The scope of this regulation includes licencing, supervision and enforcement provisions applicable to the companies, which are licenced to provide SVF. A one-year transitional period will commence on the date when the regulation comes into force. Firms already holding an SVF licence granted under the previous regulatory framework may continue operating. Nevertheless, they are required to complete the implementation of the relevant measures set out in the new regulation by the end of the transition period.

Abdulhamid M. Saeed Alahmadi, Governor of the Central Bank of the UAE, said, “We are confident that the new SVF regulation will strengthen the public’s confidence in the use of digital products and services and foster further development and innovation across the payments industry.

“The new regulation constitutes an important milestone in the continued development of a robust regulatory framework for stored value facilities and the digital payments industry as a whole. It is in line with the CBUAE’s objectives aimed at safeguarding the stability and integrity of the financial system and payment infrastructure in the UAE, and facilitating further development of digital payments. This regulation will ensure a level playing field for market participants and will help maintain the UAE’s status as an international financial centre and a leading payment hub.”

Meanwhile, the Ministry of Finance, MoF, has organised two virtual workshops titled ‘The Frameworks of implementing legislation governing Multinational Groups of Entities, MNEs, reports from 2-3 November 2020.

The workshops sought to identify the main points around implementing the UAE’s Cabinet Resolution no. 44 of 2020, which covers the legislation governing MNEs reports, and clarifies the private sector’s responsibilities in this area. That, in addition to providing guidance on the functions of the Country by Country Reporting, CbCR, notification system.

Younis Haji Al Khoori, Under-Secretary of MoF, inaugurated both workshops, where more than 230 participants from multinationals in the private sector, and employees from the International Financial Relations and Organisations Department at MoF attended.

He stressed that the UAE, as one of the signatories of the Organisation for Economic Co-operation and Development, OECD’s comprehensive framework for international tax cooperation, is committed to implementing the standards in accordance with the OECD’s Base Erosion and Profit Shifting, BEPS, Project. CbC Reporting is core in BEPS’s Action 13, which aims to prevent tax planning - which exploits gaps in tax rules to artificially transfer profits to low or tax-free locations where there is low economic activity, or even none.

Al Khoori said, “MNEs reports bridge the gap between the information available to taxpayers and the tax authorities. These reports also provide tax authorities with an overview of the group’s economic activities and global financial results. According to Action 13 of BEPS, big MNEs groups are required to file a CbC Report that should provide a breakdown of the Multinational Group’s global revenue, profit before tax, accrued income tax and certain other indicators of economic activities for each jurisdiction in which the MNE group operates.”

The workshops reviewed the latest developments related to the UAE’s requirements regarding CbCR; the CbCR notification system; the most important updates approved by the OECD on the CbCR; and introducing the most important guidelines to be followed when preparing CbCR.

In the UAE, CbCR were submitted in 2019, and the report was applied to UAE-based MNEs that have more than Dhs3.15 billion of global revenues. The legislation was amended in 2020 based on OECD’s recommendations, and compliance is only required for UAE-based groups.

Meanwhile, the Dubai Investments today reported a 102% surge in the third quarter net profit to AED213 million, compared to AED105 million in the corresponding period last year.

The net profit for the nine-month period ending 30th September 2020 was AED418 million compared to AED458 million for the same period last year.