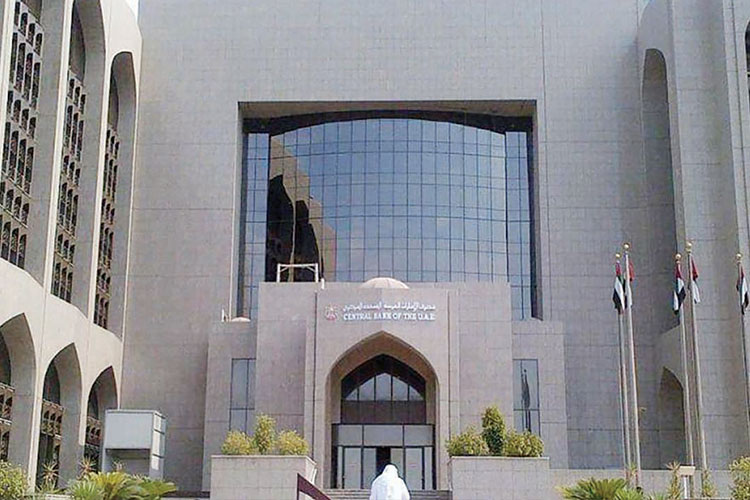

CBUAE launches new ‘Overnight Deposit Facility’ for banks

This photo is used for illustrative purpose.

“The introduction of the ODF is the first step towards implementation of the new Dirham Monetary Framework announced earlier this year,” the UAE Central Bank said in a statement on Monday.

It added, “The new deposit facility shall be the prime facility for managing surplus liquidity in the UAE banking sector prior to the launch of the Monetary Bills Programme and shall replace issuance of one-week Certificate of Deposits.

“With the introduction of ODF, the general stance of the CBUAE’s monetary policy will be signaled through the interest rate of the ODF, which becomes the main policy rate of the CBUAE and will be referred to as the Base Rate. Accordingly, the CBUAE expects that overnight money market rates should hover around the Base Rate under normal markets conditions.

“The Base Rate, which will be anchored to the US Federal Reserve’s Interest on Excess Reserves, should also provide the effective interest rate floor for overnight money market rates.”

The CBUAE said it will also be providing a variant facility of the ODF to cater for licensed financial institutions that carry on all or part of their activities and business in accordance with the provisions of Shariah rules. “Until this facility becomes operational, the CBUAE will continue to offer to these institutions the one-week commodity Murabaha-based Islamic Certificate of Deposits, which will be breakable on daily basis,” CBUAE explained.

Commenting on the launch of the ODF, Abdulhamid Saeed, Governor of CBUAE, said, “The introduction of this new facility is a reflection of the CBUAE’s continuous efforts to achieve the objectives of its monetary policy and to foster money market developments in the UAE. This new facility will support banks operating in the UAE in proactively managing their day-to-day liquidity and help in aligning overnight money market rates with the Base Rate in normal market conditions.”

The Board of Directors of the Central Bank of the UAE (CBUAE) held recently its 6th meeting this year via video-conference. The meeting took place under the chairmanship of Hareb Masood Al Darmaki, the Chairman of the Board.

The meeting was attended by Abdulrahman Saleh Al Saleh, Deputy Chairman of the Board, Abdulhamid Saeed, the Governor and Board members Younis Haji Al Khoori, Khaled Mohammed Salem Balama, Khalid Ahmad Al Tayer and Ali Mohammed Al Madawi Al Remeithi, and a group of senior CBUAE employees.

The Board reviewed the utilisation of the Targeted Economic Support Scheme (TESS) and noted the progress in the drawdown of the liquidity facility and the deferrals provided by banks to eligible customers. Up to date, banks operating in the UAE availed 88% of the Dhs50 billion liquidity facility, equivalent to Dhs44 billion of allocated funds.

A total of 26 banks availed the TESS liquidity facility, with 17 banks drawing down 100%.

More than 140,000 eligible customers have already benefited from the TESS liquidity facility. The Board also reviewed the details of support provided to customers outside of the TESS liquidity facility.

More than 180,000 customers have benefited from such support, with a total deferral value of approximately Dhs8 billion.

Furthermore, the Board took note of all the relief measures adopted to mitiage the effects of Covid-19, including liquity measures and guidances and notices circulated to banks by the CBUAE.

The Board of Directors reviewed reports on financial system surveillance, resilience of the UAE banking sector to stress, and macro-financial developments. The Board completed the discussion on other agenda items and took appropriate decisions.

The Central Bank of the UAE also announced recently that the Money Supply aggregate M1 increased by 0.7%, from Dhs560.3 billion at the end of April 2020 to Dhs564.3 billion at the end of May 2020. The Money Supply aggregate M2 decreased by 0.9%, from Dhs1464.8 billion at the end of April 2020 to Dhs1451.9 billion at the end of May 2020. The Money Supply aggregate M3 also decreased by 0.2%, from Dhs1751.5 billion at the end of April 2020 to Dhs1747.8 billion at the end of May 2020, according to a ‘summary report’ from the bank.

WAM