Global finance leaders hopeful about modest rebound in 2020

The Governor of the Bank of Japan, Haruhiko Kuroda and Finance Minister of Japan, Taro Aso, attend a press conference in Washington. Agence France-Presse

That was the assessment on Friday from finance ministers and central bank governors of the Group of 20 major industrial countries.

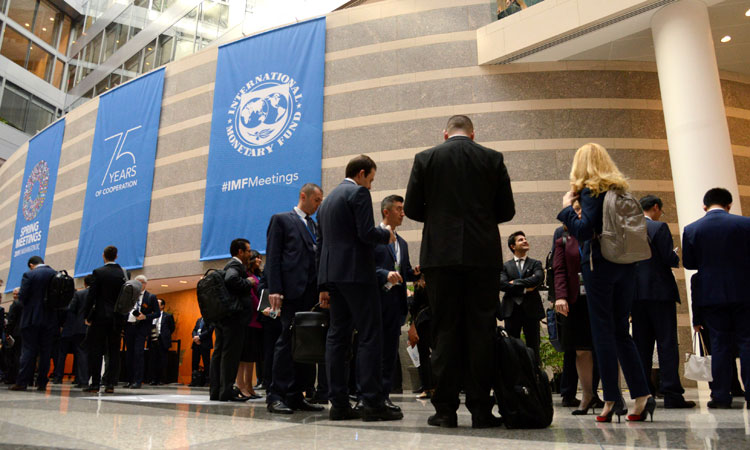

Those officials met ahead of discussions on Saturday with the policy-setting panels of the 189-nation International Monetary Fund and the its sister lending organisation, the World Bank.

The leaders of those two organizations appealed to their member countries on Friday to resolve the widening disagreements on trade, climate change and other issues, warning that the continued diversions threatened to worsen the current global slowdown.

Japanese Finance Minister Taro Aso, the current chair of the G-20 finance group, said while current conditions are less than optimal, there was still optimism that conditions will improve.

Speaking to reporters at a news conference after the G-20 discussions ended, Aso said, “We broadly agreed that the global economic expansion continues, but its pace remains weak.” Aso said the group felt that the risks remained weighted to the downside with the major threats coming from trade wars and geopolitical tensions. But he said the expectation was that growth would pick up in 2020.

Japan served as chair of the G-20 this year, a position that will be taken by Saudi Arabia in 2020.

Group of 20 finance leaders also agreed to set strict regulations on cryptocurrencies such as Facebook’s Libra, warning that issuance of such “stablecoins” should not be allowed until various global risks they pose have been addressed.

The agreement came after a G7 working group warned that when launched on a wide scale, stablecoins - digital currencies usually backed by traditional money and other assets - could threaten the world’s monetary system and financial stability.

Finance chiefs of the G20 major economies agreed that while stablecoins could have potential benefits of financial innovation, they give rise to a set of “serious” public policy and regulatory risks.

“Such risks, including in particular those related to money laundering, illicit finance, and consumer and investor protection, need to be evaluated and appropriately addressed before these projects can commence operation,” the G20 finance leaders said in a statement issued after their meeting.

Meanwhile, Bank of Japan Governor Haruhiko Kuroda said on Friday the central bank could ease monetary policy further if needed to spur growth, shrugging off views that it has used up ammunition to fight the next economic downturn.

A senior International Monetary Fund official also said deepening negative interest rates remained an option if the BoJ were to ease, though adding that any such move should be accompanied by fiscal and structural steps to be effective.

The United States is represented at the meetings by Treasury Secretary Steven Mnuchin and Federal Reserve Chairman Jerome Powell.

The IMF in its updated economic outlook prepared for this week’s meetings projected the global economy would expand by just 3% this year, the weakest showing in a decade, with 90 per cent of the globe experiencing a downshift in growth this year. But it is forecasting growth will accelerate slightly to 3.4% in 2020, still below the 3.6% global growth seen in 2018.

“Trade tensions are now taking a toll on business confidence and investment,” IMF Managing Director Kristalina Georgieva said in an opening speech to finance officials on Friday.

Georgieva, a Bulgarian economist who had been the No. 2 official at the World Bank, recognized the accomplishments of her IMF predecessor, Christine Lagarde, the first woman to head that agency. Lagarde was in the audience for the speech.

“As someone who grew up behind the Iron Curtain, I could never have expected to lead the IMF,” Georgieva said. She noted she had witnessed the devastation of bad economic policies when her mother lost 98% of her life savings during a period of hyperinflation in the 1990s in Bulgaria.

World Bank President David Malpass said the slowdown in global growth was hurting efforts to help the 700 million people around the world living in extreme poverty, especially in nations trying to cope with a flood of refugees from regional conflicts.

“Many countries are facing fragility, conflict and violence, making development even more urgent and difficult,” he said.

The fall meetings of the IMF and World Bank meetings were expected to be dominated by the trade disputes triggered by the Trump administration’s get-tough policies aimed at lowering America’s huge trade deficits and boosting US manufacturing jobs. So far, those efforts have made little headway.

In addition to the battle between the United States and China, higher US tariffs went into effect Friday on $7.5 billion in European goods coming into the United States in a dispute involving plane subsidies.

Agencies