FTA kick-starts campaign on expansion of Excise Tax

The campaign started on Monday with a workshop in Abu Dhabi.

The Federal Tax Authority (FTA) has launched its comprehensive awareness campaign, which seeks to introduce the objectives and procedures of the expansion of Excise Tax, and requirements for registering in the FTA’s electronic system.

The campaign consists of a series of workshops for businesses that are not yet registered with the FTA for Excise Tax purposes. It started on Monday (September 16, 2019) with a workshop in Abu Dhabi, to be followed by a similar session on Wednesday (September 18) in Dubai, and a third workshop next Monday (September 23) in Ajman for businesses in the northern emirates.

In an official press statement, the Authority explained that the campaign is part of the executive procedures to implement Cabinet Decision No. (52) of 2019 on Excise Goods, Excise Tax Rates, and the Method of Calculating the Excise Price, whereby the scope of products subject to Excise Tax was expanded to include electronic smoking devices and liquids, in addition to sweetened drinks. These new products join the list of Excise Goods that have been subject to the tax since its launch on October 1, 2017, namely, tobacco and tobacco products, energy drinks, and carbonated beverages.

Along with participants - including representatives from businesses directly affected by the Cabinet Decision, as well as Tax Agents - the FTA experts called on producers, importers, and stockpilers of sweetened drinks, electronic smoking devices, and electronic smoking liquids, to, first, register their business for Excise Tax, and then register each individual Excise Good in accordance with the terms and conditions of Cabinet Decision No. (52) of 2019. The registration portal is available 24/7 on the FTA’s official website. The Authority’s representatives cautioned attendees to register at the soonest to ensure their businesses are in full compliance with Cabinet Decisions No. (52)for 2019, and avoid administrative penalties for late registration. Producers, importers, and stockpilers of sweetened drinks, electronic smoking devices, and electronic smoking liquids, must abide by the new procedures when registering, and make sure they have all the necessary documents.

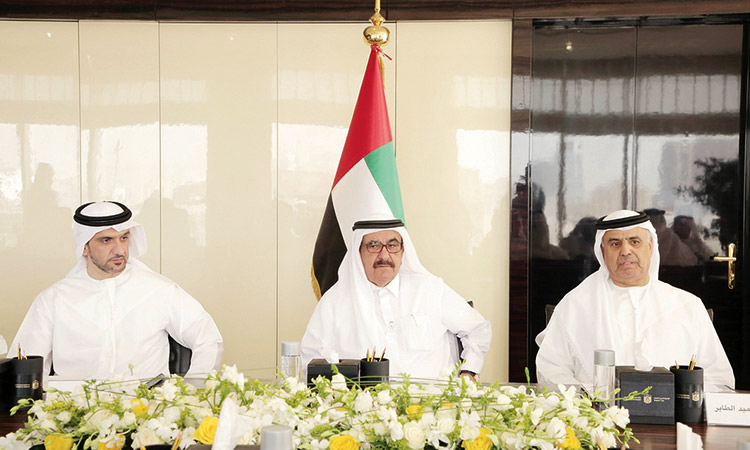

FTA Director General His Excellency Khalid Al Bustani asserted that the awareness workshop is part of the Authority’s intensive plans to raise awareness about the tax system among businesses, and to maintain constant communication with all economic sectors, keep them informed with all updates on tax regulations and procedures, listen to their suggestions, and address any obstacles they may face while implementing the UAE tax system.

The FTA Director General assured that the.expanding the list of Excise Goods to include electronic smoking devices and liquids, as well as sweetened drinks, is in line with the leadership’s directives to enhance the UAE’s competitiveness and expedite plans to create a healthy society that consumes less harmful products that affect individual health, as well as the environment.

The workshop showcased the ongoing developments the FTA has been implementing since taxes were first launched in October 2017. H.E. Khalid Al Bustani underlined the Authority’s commitment to strengthening its partnerships with entities from both the government and private sectors, where these relations are considered to be essential for successfully implementing the UAE tax system.

FTA experts at the workshop explained that the new Cabinet Decisions identify sweetened drinks as any product to which a source of sugar or sweetener is added and is produced as either a ready-to-drink beverage or as concentrates, gels, powders, extracts, or any other form that can be converted into a sweetened drink. In that regard, sugar includes any type of sugar determined under Standard 148 of the GCC Standardization Organization as ‘sugar’ and sweeteners include any type of sweeteners determined under Standard 995 of the GCC Standardization Organization as ‘sweeteners authorised for use in food products’.

Meanwhile, electronic smoking devices mentioned in the Decision include any e-cigarettes devices, tools, and the like, whereas electronic smoking liquids include all liquids used in electronic smoking devices, whether or not they contain nicotine or tobacco.

Participants at the workshop applauded the Authority’s efforts to raise awareness regarding the application of the tax system, praising the FTA’s responsiveness to enquiries from businesses, and reiterating their commitment to implementing tax regulations and educating their customers about the system’s objectives and benefits.

The Federal Tax Authority was established by Federal Decree-Law No. (13) of 2016 to help diversify the national economy and increase non-oil revenues in the UAE through the management and collection of federal taxes based on international best practices and standards, as well as to provide all means of support to enable taxpayers to comply with the tax laws and procedures.